Tennessee Employee Withholding Tax Form – If you want to avoid fines and interest as well as the hassle of preparing a tax return You should be acquainted about how to fill out your employee tax forms. There are a variety of tools at your disposal to guide you through the maze.

FICA employer contribution

The FICA, Social Security and Medicare taxes are three federal taxes that companies must deduct from the wages of their employees. Employers must submit a quarterly tax return. Taxes are reported on the form known as Form 941.

The tax that is referred to as FICA is what funds Social Security and Medicare. The 12.4% social security tax on wages is the first element.

The Medicare tax which is the second element of tax is known as the Medicare tax. FICA’s Medicare component is not subject to any upper wage base limits and therefore the tax rate is subject to changes. Employers are benefited by this since they can deduct their FICA portion as an expense of business.

The employer’s share of FICA is filed on Form 941, which is for small companies. This form allows you to provide the details of taxes taken from the paychecks of employees by the IRS.

Quarterly tax return for employer

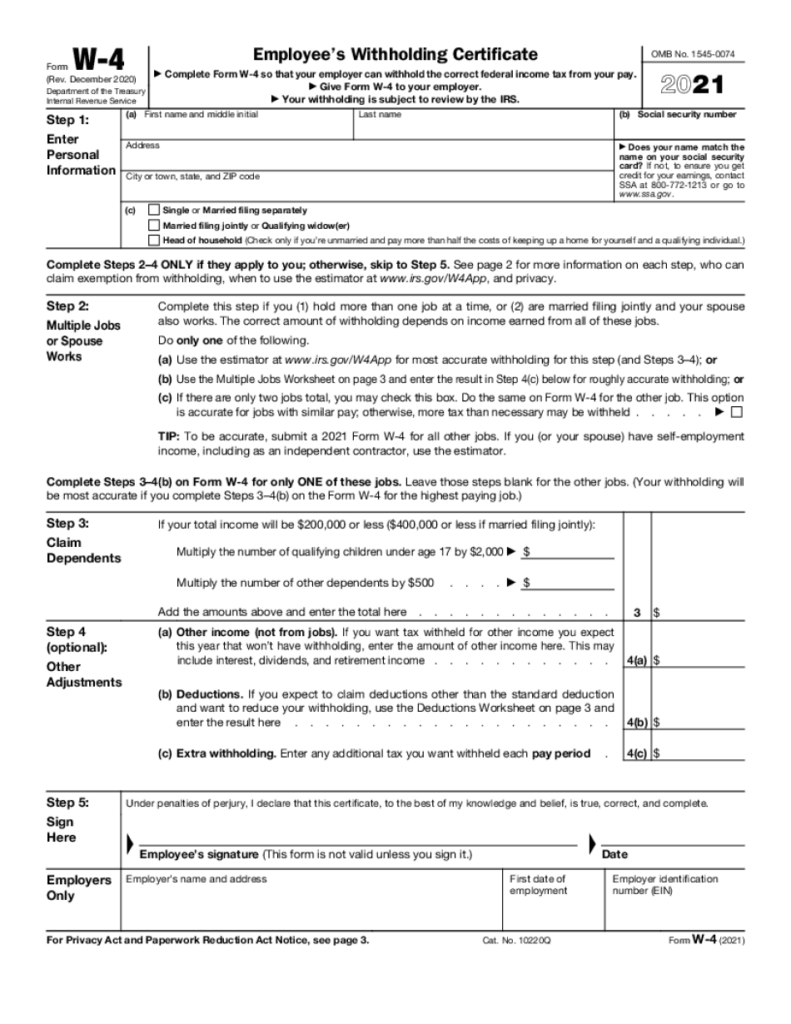

If your company is required by law to pay employment taxes it is essential to be aware of how to fill out Form 941. The form provides details regarding the federal tax withholdings and payroll taxes.

The whole amount of Social Security and Medicare taxes that are deducted from the earnings of employees have to be declared. The sum here will match the amount on the W-2 form of the employee. It is also essential to indicate how much the employee earns in tips.

You must mention the company’s name as well as the SSN of your business when you are submitting your application. The number of employees you paid in the period should also be listed.

Complete the 15 lines on your Form 1040. Each line represents different parts of your remuneration. These include the number, salaries, and gratuities of all employees.

Annual returns of workers in agriculture to the employer

As you are probably aware that the IRS Form 943 is a required file if you own an agricultural firm.This form is used to determine the appropriate amount of employee tax withholding for agricultural businesses. The form contains some important information you should be aware of. You can submit this form online. However, if you aren’t connected to the internet and you don’t have internet access, you’ll be required to send it by mail.

The best method to maximize this tax form’s potential is to use the most sophisticated payroll software. An account will be required to be registered with the IRS. The Web Upload service can be utilized to speed up the process once you have an official account number. Before you deposit, double-check the account number.

Insufficient reporting of income may lead to penalties and interest.

When you pay taxes it is essential to not underpay the government. It will be regrettable and you’ll end with a higher tax bill. If you’re not paid then the IRS may charge you with penalties. Therefore, you must to ensure that your withholdings as well as taxes are correct.

If you’re not certain of the amount of debt you have, you can use Form 2210 from IRS to determine it. Once you’ve completed the form, you can find out if you are eligible for an exemption. You may be eligible for a waiver if you live in the state that has high taxes or significant unreimbursed work expenses.

To calculate your withholdings you can utilize calculators. With the IRS Tax Withholding Calculator, you can accomplish this.