Texas New Employee Hire Forms – It’s possible that you’ll have to fill out a range of documents, such as I-9 and W-4 forms in the event that you hire new staff. These documents are required to confirm that your staff is allowed to legally operate in the United States. This article covers the forms you’ll need.

Checks that were written in the past

Employers are able to conduct a variety of background checks when deciding who to hire. There are a variety of background checks that employers can conduct to determine who they will hire. This includes ID checks, credit verifications, and motor vehicle record checks. These checks confirm that the applicant is who they claim to have been and that they meet the requirements of the position.

Background checks could be useful to defend the business and its customers as well as its staff. Speeding fines, criminal convictions, and poor driving habits are a few of the potential red flags in the past of a candidate. There are indicators of danger in the workplace, such as violence.

Many businesses will use an outside background investigator company. They’ll have access to a database of information from all 94 federal courts across America. Some businesses choose to wait until the stage of a conditional job offer prior to conducting a background screening.

Background checks might require a long time. Employers must compile a list. It is also important to allow applicants plenty of time to answer. The average response time is 5 business day.

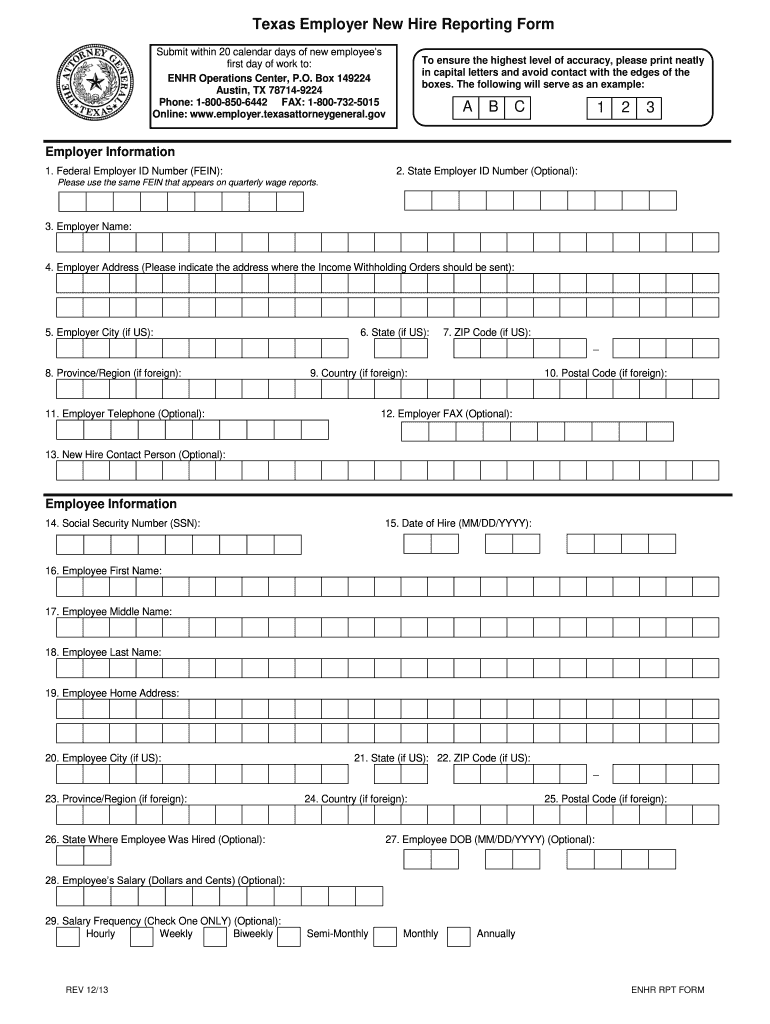

Formula I-9

If they are a brand new employee, each employee has to fill out an I-9 form. Federal contractors as well as state employees are required to comply. This process is time-consuming and difficult.

The form is comprised of several sections. The first is the most essential and must be completed before you begin working. This includes both the employer’s identifying and worker’s pertinent information. You must show proof that a foreign national is allowed to work in the United States if you want to hire them.

When you’ve completed Section 1, make sure that the rest of the form is completed on time. The necessary Form I-9 should also exist kept on file for 3 years after the date of hiring. It is imperative to continue making the necessary payments on Form 6A.

When filling out Form I-9, you should consider the various ways that you can minimize your vulnerability to fraud. You should ensure that each employee is added to E-Verify. Administrative and donation costs must be made in time.

Forms W-4

W-4 forms are one of the most crucial documents new employees must complete. On this page it is possible to see the tax deduction from their wages. You can also use this page to get more information regarding your tax obligations. It is possible that people will receive an increase in their pay when they have a greater understanding about the deductions the government will make from their earnings.

It’s vital as it informs employers how much to deduct employees’ paychecks. The information is used for federal income taxes. To avoid unexpected surprises, it could be beneficial to track how much you withhold.

The W-4 form is easy to fill out and includes your name, address as well as other details that could have an impact upon your federal income taxes. It is possible to avoid paying too much by making sure that you complete the form correctly.

There are a variety of ways to fill out the W-4. Online submission is possible and manual printing. Whatever method you select to use, it is important that you fill out the paperwork prior to the start of your first pay period.

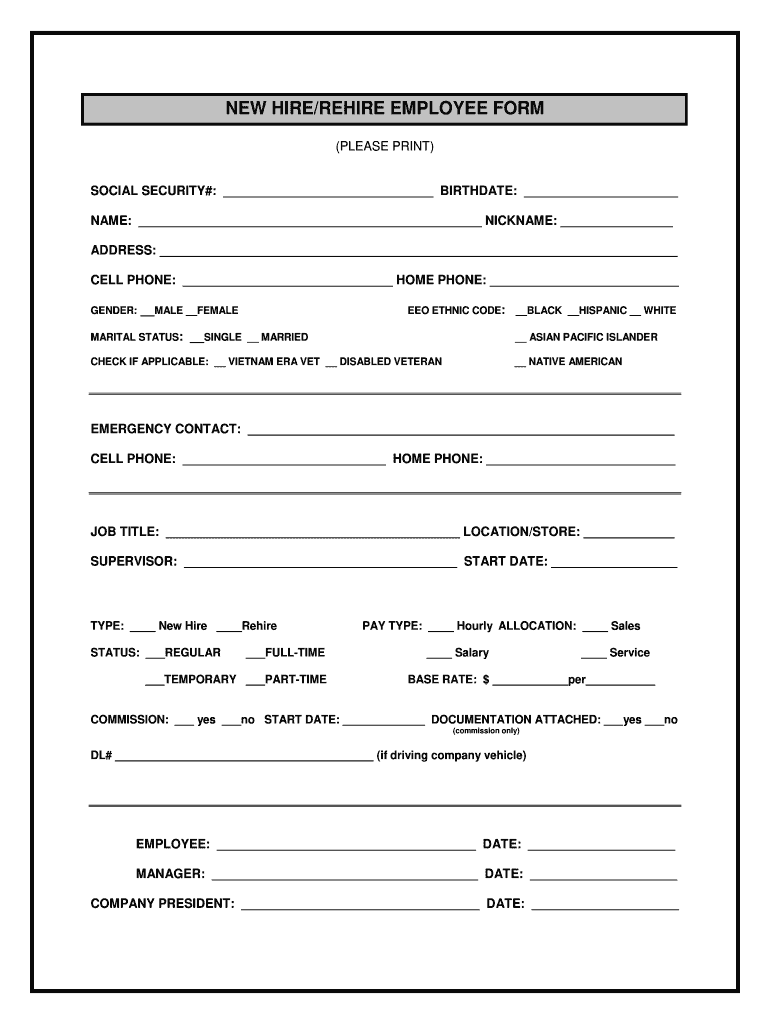

applying for a job

Employers use job application forms to applications to evaluate applicants. They aid in forming a clear picture of the applicant’s education background and professional experiences.

If you complete a job application form, personal information such as contact details, will be required. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

The application for jobs can be made on the internet or in writing. Your application should be easy to read and contain all required information.

Before applying for an opportunity, it is recommended to seek out a professional who is qualified. You can ensure that you’re not sending any illegal content by doing this.

A majority of employers store applications on file for a long time. Employers can then call potential applicants to discuss openings in the near future.

On the forms used to apply for jobs on job applications, you’ll often be requested to supply your full name address, postal address, and email address. These are typically the best way for companies to reach out to applicants.