Uc Davis Employee Tax Form – You need to be familiar with the steps that are required to submit employee tax returns. This will help you avoid interest, penalties, and all of the hassle associated with it. You can choose from a wide range of options to help you navigate the maze.

FICA employer contribution

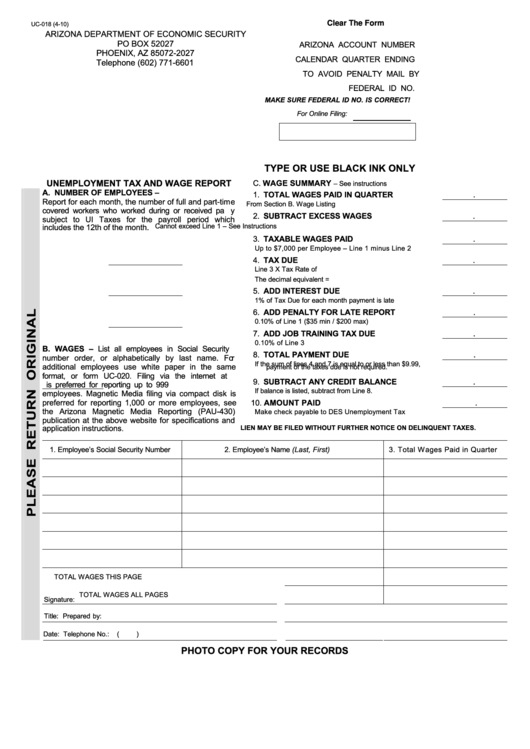

The FICA (Federal Income Taxes), Social Security (Medicare taxes) are the three taxes that federal law requires businesses to deduct from the wages of employees. Every quarter, employers are required to submit a tax return for their employers. These taxes are reported using Form 941.

FICA is the federal tax that is what funds Medicare as well as Social Security. The 12.4 percentage of wage income social security levy is the primary component of the tax.

The Medicare tax is the second part of the tax. The Medicare tax is the second component. It doesn’t have any upper wage base limits which means that the tax rate can fluctuate. Employers are benefited by this since they can write off their FICA portion as an expense for business.

For smaller companies, Form 941 will report the employer’s FICA portion. The IRS uses this form to reveal details about the taxes taken out of an employee’s pay.

The quarterly tax return of the employer

If your business is legally required to pay taxes on employment, it is essential to be aware of how to fill out Form 941. This form outlines your federal income tax withholdings, as well as the payroll tax.

It is mandatory to report the total amount of Medicare and Social Security taxes that were taken out of the earnings of employees. The total here must be equal to what is stated on the W-2 for the employee. Also, you must disclose any tips your employees receive.

In your submission, you must include the name and SSN for your company. It is also necessary to mention the number of employees that you employed during the period.

The Form 1040 includes 15 lines to be filled in. The different components of your compensation are presented on each line. They include the total amount of gratuities, wages, and salaries of all employees.

Farmers receive a yearly return from their employers

It is likely that you are aware that IRS Form 943 must be completed if you run an agriculture firm. It’s used to determine how much tax you are able to withhold from employers of agricultural businesses. The form contains a few important details that you need to be aware of. The form can be submitted online. If, however, you aren’t connected to the internet or a computer, you might be required to submit it via mail.

A payroll program that is professional and reliable is the ideal way to maximize the value of your tax form. You will need to open an account to be registered with the IRS. After you have obtained a legal account number, you can accelerate the process by using Web Upload. You may want to double-check your account number before making a payment.

Insufficient reporting of income may lead to penalties and interest.

In full payment of your tax bill is a great idea. It’s not a good idea to overpay the government. This will ultimately cost you the money. In fact, if you are underpaid, the IRS could fine you, so you must be sure that your withholdings are accurate.

If you’re not sure what amount of debt you owe, you can use Form 2210 from IRS to calculate it. Find out whether the waiver is granted once you have completed this form. You may be eligible for a waiver if you reside in the state that has high taxes or significant work expenses that are not reimbursed.

Additionally, you can use calculators to determine your withholdings. By using the IRS Tax Withholding Estimator, you can estimate your withholdings.