Umd Employee Insurance Tax Form – If you want to reduce penalties, interest, or the hassle of submitting tax returns for your employees, it’s crucial to be aware of the proper way to manage your employee tax forms. There are many tools to help through this maze.

FICA employer contribution

The FICA, Social Security, and Medicare taxes are three taxes the federal government requires that most companies deduct from their employee pay. Employers must file a quarterly return detailing the tax obligations of their employers. Taxes are reported on Form 941.

The federal tax referred to as FICA is the source of funding for Social Security and Medicare. The first component of FICA tax is the 12.4% social security levy on employee earnings.

The Medicare tax forms the second portion of the tax. FICA’s Medicare component is not subject to any upper wage base limitations which means that the tax rate is subject to change. This allows employers to write off FICA as business expenses.

For small-sized businesses, Form 941 is used to record the employer’s share of FICA. The IRS may utilize this form to provide details on taxes withheld at the employee’s wages.

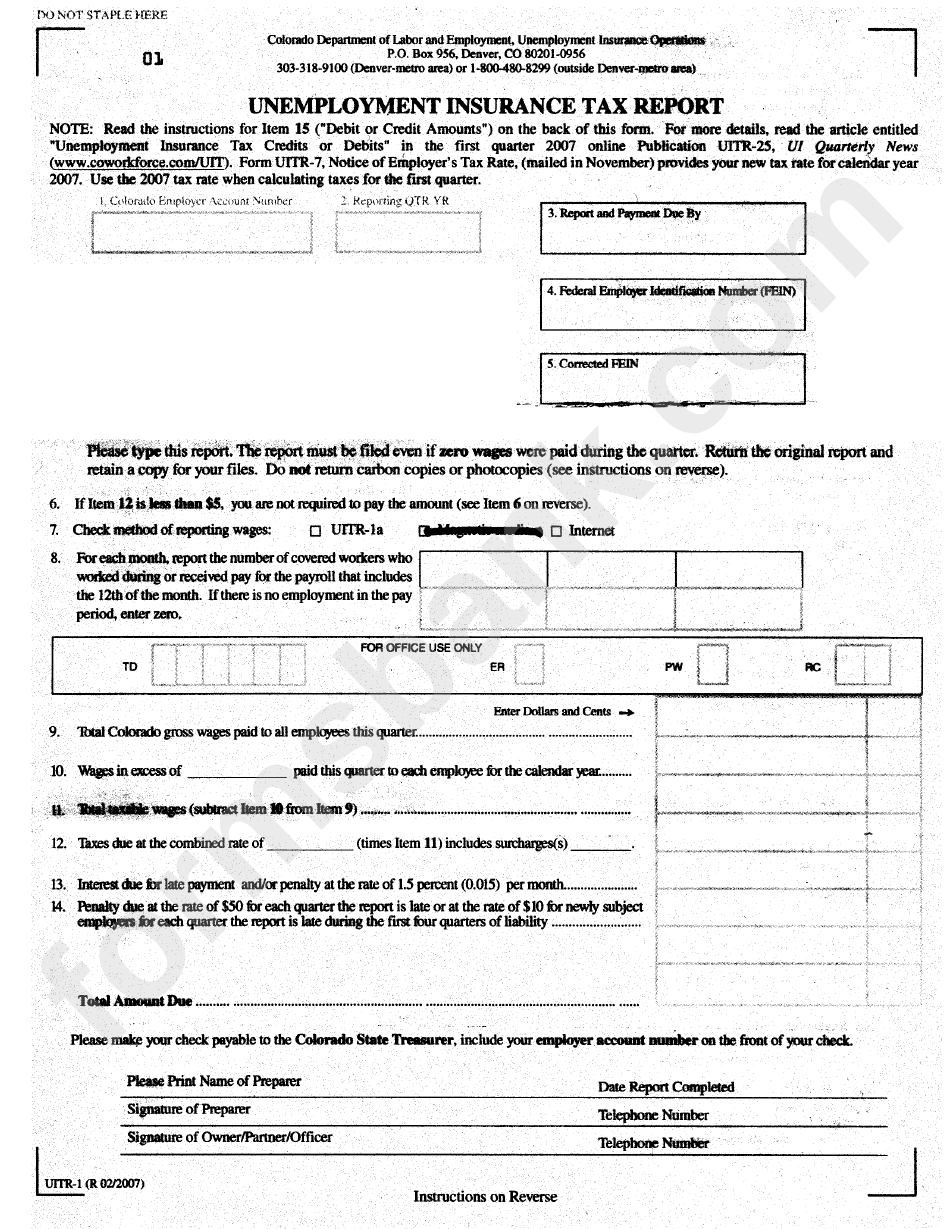

quarter’s tax return for the employer

If your company has to pay employment taxes It is crucial to understand how to fill out and submit Form 941. The form provides information about your federal income tax withholdings as well as tax on payroll.

The total sum of Social Security and Medicare taxes deducted from employee earnings must be reported. The amount reported must be the same as that shown on an employee’s W-2. It is also essential to show how much each employee gets in tips.

The submission should include your business’ name and SSN. Also, you must include the number of employees you’ve paid each quarter.

It is necessary to complete 15 lines on your Form 1040. Each line describes the various elements of your pay. They include the total amount, salaries, and gratuities of all employees.

The workers in the agricultural sector get a monthly payment from their employers

You are aware that the IRS Form 933, which is mandatory for all agricultural enterprises, is used to calculate the proper amount of withholding tax by agricultural employers. There are certain important information to consider while filling out the form. Online submissions are possible, but you may have to submit it by mail.

Payroll software that is expertly designed and certified will enhance the tax form’s value. Tax accounts should also be registered through the IRS. It is possible to expedite the process by making use of Web Upload, once you have created a valid account. It is advisable to verify your account’s number prior to making a payment.

If the income isn’t reported, it could result in penalties or even interest.

Taxes that are paid on time are essential. It’s not wise to pay less than the amount owed to the government. This will ultimately cost you money. If you’re not paid you could be fined by the IRS could fine you, so you must be sure that your withholdings are accurate.

For a quick calculation of your debt, you can download Form 2210 from IRS. Find out what waivers are available after you’ve completed this form. If you’re in a country with a high tax rate or have a substantial amount of unreimbursed job expenses This could happen.

Calculators can also be utilized to estimate your tax withholding. With the IRS Tax Withholding Expert it is possible to do this.