Us Income Tax Form For Salaried Employee – If you’re looking to stay clear of the sting of interest and fines as well as the hassle of filing an income tax return, you should be familiar about how to fill out the tax forms for employees. You have many options to help you navigate the maze.

FICA employer contribution

The FICA, Social Security, and Medicare taxes are three taxes the federal government requires that most companies deduct from their employee pay. Employers must file an annual tax return for their employers. These taxes are reported using Form 941.

FICA is the federal tax, is used to fund Medicare and Social Security. The main component of FICA tax is the 12.4 percentage Social Security levy that is levied on employees’ earnings.

The Medicare taxes are the second tax component. FICA’s Medicare component does not have any restrictions on the wage base, so the tax rates may be adjusted. Employers can claim FICA as an expense for business.

For smaller businesses The Form 941, that reports the employer’s portion FICA is mandatory. The form is utilized for the IRS to provide information about the tax deductions made by an employee’s paycheck.

Tax returns for quarterly periods from the employer

If your business is required by law to pay tax on employment it is vital to understand how to complete the Form 941. You will find details on the federal income and payroll tax on the form.

It is required to report the total amount of Medicare and Social Security taxes that were taken from the employee’s earnings. The amount will be equal to the amount shown on the W-2 form. You must also disclose the tips each employee receives.

Your report must contain your company’s name as well as your SSN. It is also necessary to include the number of workers who you employed in the period.

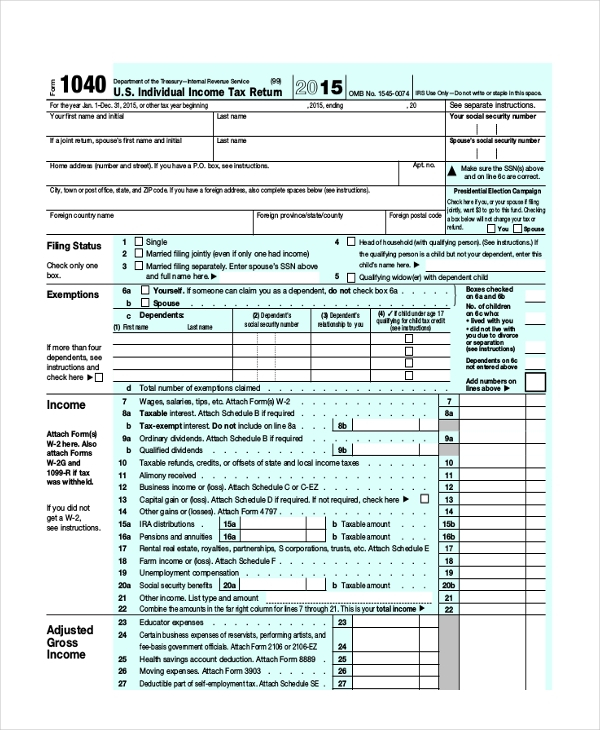

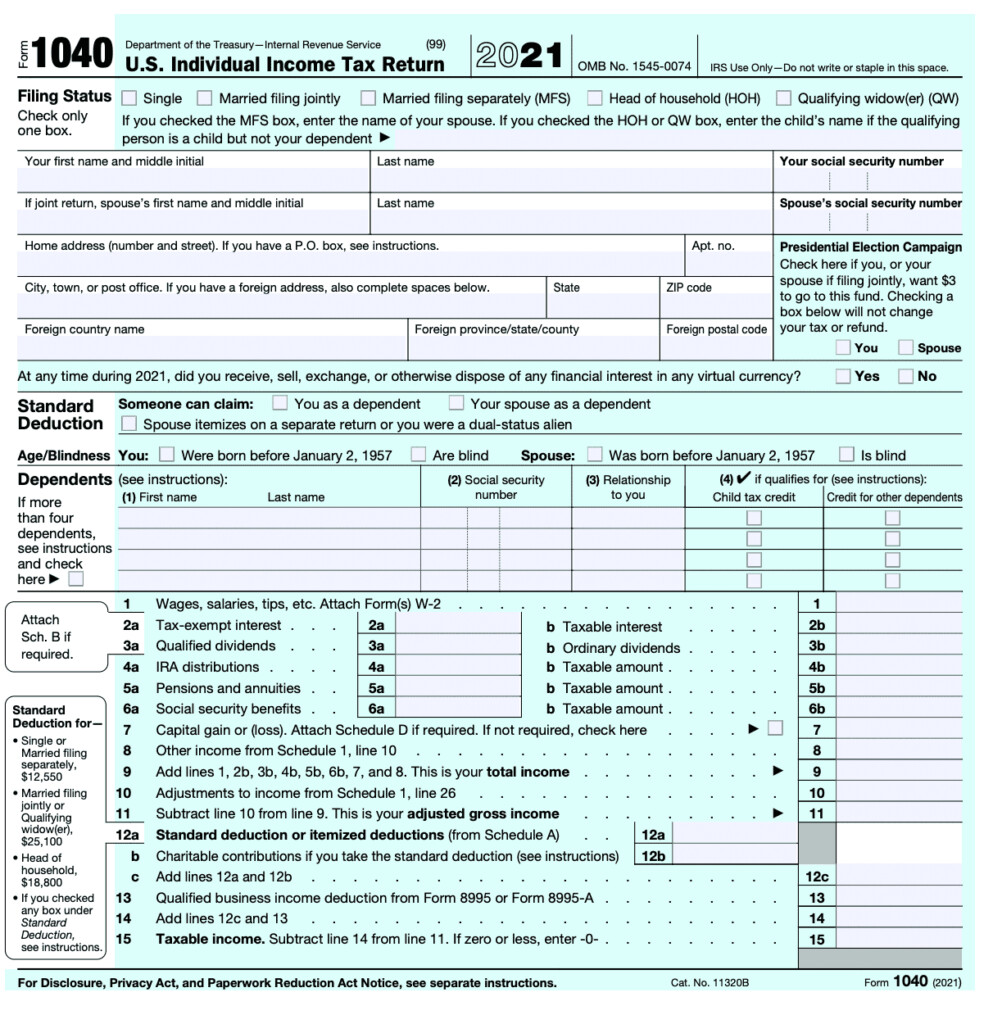

Complete the 15 lines on the Form 1040. Each line details the various components of your compensation. They include the total amount as well as the salaries and gratuities of all workers.

Annual investment return for employers for agricultural workers

The IRS Form 943, which you may have heard of is required if your agricultural enterprise is required to be registered with IRS. This form determines the proper amount of tax withholding from employees for agricultural employers. This form has some important information you need to be aware of. The form is available on the internet. If you don’t have an internet connection the form may have to be sent in.

Employing a payroll program that is professional is the best way to maximise the benefit of this tax form. A bank account is required by the IRS. Once you have a legitimate account number, you may speed up the procedure through the Web Upload service. Make sure you verify the number before you make the deposit.

The incorrect reporting of income can result in interest and penalties.

It is important to be cautious not to pay too much to the government when you pay your taxes. It’s not wise to pay less than the amount owed to the government. It will cost you cash. If you’re not paid then the IRS could impose fines on the taxpayer, so be sure that your withholdings are correct.

Use Form 2210 from the IRS to determine your debts if you’re unsure of how much you owe. Once you submit this form, you’ll be able to determine your situation qualifies to receive an exemption. You may be eligible if you reside or work in an extremely taxed state.

There are calculators for estimating your withholdings. With the IRS Tax Withholding Estimator, you are able to calculate your tax withholding.