Us State Tax Form For New Employee – There is a chance that you’ll need to fill out a range of documents, including I-9 and W-4 forms in the event that you hire new staff. These forms are required to confirm that your staff is allowed to legally operate in the USA. This article will outline the forms that you will require.

Checks made in the past

Employers can perform a variety of background checks when deciding who to employ. Verifications of education, credit and identification are just a few of them, along with motor vehicle records checks. These checks verify that the person applying for employment is who they claim to have been and that they meet the requirements of the position.

Background checks can help protect clients and employees as well as the company. Past criminal convictions or speeding offenses, as well as poor driving habits could all be warning signs. Signs of occupational danger, such violence, could also be present.

The majority of businesses employ an outside background investigation company. They will have access now to all the 94 United States Federal Courts. Some businesses prefer waiting until they get a conditional employment offer before doing a background check.

Background checks can take a long time. Employers have to create a list. It’s important that applicants are given the time to reply. It can take five days to receive an average response.

Formula I-9

If they are a new employee, each employee must complete an I-9 form. State employees and federal contractors must follow the rules. But, the process can be difficult and time-consuming.

There are numerous parts to the form. The first one that is the most essential is required prior to the time you begin work. This includes both the employer’s identification as well as the worker’s relevant information. You will need to show proof that the person is allowed to work in the United States if you want to hire them.

Once you have completed Section 1, it’s essential to fill out the rest of your form on time. Keep the Form I-9 required for your appointment date for three years. You should continue to make the required payments on Form 6A.

When filling out the Form I-9, think about ways to decrease the chance of being fraudulent. In the beginning, make sure that all employees are included on the database E-Verify. It is also important to submit your donations and administrative costs on-time.

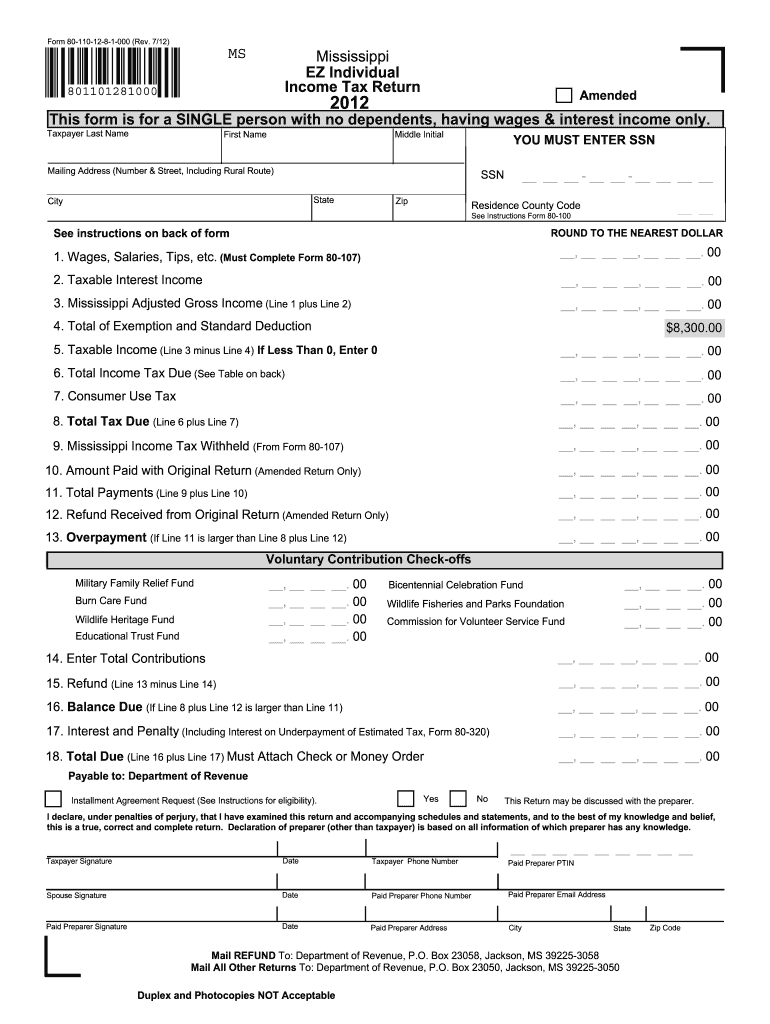

Formulas W-4

W-4 forms are among the most crucial documents new employees need to complete. The tax amount deducted from their earnings is displayed on this page. It can also help people to understand their tax liabilities. They could be eligible to get a bigger check if they have a better knowledge of the deductions that the government can make from their income.

W-4 is crucial since it provides companies with guidelines on the amount to deduct from the wages of employees. Federal income taxes are computed using this information. It can be beneficial to keep the track of your withholdings so that you can stay away from shocks that could surprise you in the future.

The W-4 forms will include your address and name and any other details that might affect the federal income tax you pay. To avoid paying more than you should, make sure you fill in the form in a timely manner.

There are many ways to complete the W-4. It is possible to fill out the form online or print it and then manually fill the form manually. Whatever method you choose to submit, make sure you submit all required paperwork prior to receiving your first paycheck.

seeking a job

Employers use job application forms to applications to assess applicants. They aid in creating a precise image of an applicant’s academic background and professional experiences.

Personal information, contact details, and other information are required when you submit an application form. Make sure you have the opportunity to confirm the accuracy and correctness of the information.Additionally, you can be requested to attest that you comprehend the application’s conditions.

Application for employment can be made on the internet or via post. It is important that your application be concise and concise.

Before you submit your application, ensure that you consult a qualified professional. In this way you will be able to ensure that your resume doesn’t contain illegal content.

Many employers keep applications on file for quite a long time. Employers may contact candidates to ask about future opportunities.

When filling out forms for job applications On job application forms, it is standard to request your complete name along with your email address, address, and phone number. These are typically the best ways for companies to reach out to candidates.